This payroll terms glossary contains the most comprehensive collection of definitions of various payroll terms & compliance terms on the internet.

Basic payroll terms such as types of salary components & leaves have been explained in the beginning and as you keep reading, you’ll see advanced payroll terms and payroll abbreviations related to taxation and labour laws.

Wherever required, links to detailed resources related to various payroll terms & acronyms are also given in the glossary. So, keep reading this amazing payroll glossary to familiarize yourself with various aspects of payroll & compliance in India.

Payroll Earnings – Payroll earnings are amounts paid to employees in form of various salary components such as basic pay, house rent allowance, sales incentives, etc.

Sum of all earnings make up the total salary of employees and they get the final salary after some deductions from their earnings. All earnings are usually shown on the left-hand side of pay slip.

Payroll Deductions – Payroll deductions are amounts deducted from employee’s salary (or earnings) by the employer for things such as government taxes and employee benefits program.

Employees receive less money than their total salary in bank accounts because of various mandatory and voluntary deductions such as income tax, provident fund, profession tax, etc. All deductions are usually shown on the right-hand side of pay slip.

Fixed Pay – Fixed pay is the guaranteed salary that employees get on monthly basis irrespective of their individual performance, team’s performance, or company’s performance. Fixed pay is pre-defined and is clearly communicated to employees at the beginning of their job.

Base salary, house rent allowance, conveyance allowance, dearness allowance, leave travel allowance, etc. are some common examples of fixed pay components.

Variable Pay – Variable pay, pay for performance, or risk pay, is the compensation, which unlike fixed pay, must be earned every time to be obtained. Variable pay is not guaranteed and is paid only on the achievement of specific qualitative or quantitative goals by individual employee, team or the company.

Variable payment is usually paid out quarterly, half yearly, annually, or on completion of a specific goal. Incentives, bonus, profit sharing, sales commission, etc. are some common examples of variable payment.

Cost to Company (CTC) – Cost to company (CTC) is the total cost of monetary & non-monetary benefits that an employer incurs on an employee during one year.

Generally, the salary offered to employees in India is in form of CTC and the detailed breakup of various salary components (basic, HRA, PF, allowance, etc.) that are included in CTC is given to employees in their offer letters.

Some employees make a mistake of assuming that they will get entire amount mentioned as CTC in their bank account, but it is not true. A company calculates CTC after including all costs that the company incurs on behalf of an employee, even if the employee doesn’t receive that money.

E.g. company might have taken a health insurance policy for the employee at a premium of Rs. 30,000 per year and so, while the employee doesn’t receive this money, the company is still paying it and therefore, it includes this amount in CTC of the employee.

Similarly, a variable salary of Rs. 2 lakhs per year, that you are supposed to receive on achieving your targets, might be included in your CTC, but you might not get that amount if you don’t achieve the targets.

Allowance – Allowance is the fixed amount paid to employees, in addition to basic salary, for covering expenses of activities such as travelling to the workplace, renting a house, or eating food. Generally, payment for all allowances is included in the CTC of employees.

Allowances are of 3 types – non-taxable allowances (Allowance paid by UNO, sumptuary allowances, etc.), partly taxable allowances (House rent allowance, medical allowance, etc.), and taxable allowances (overtime allowance, dearness allowance, etc.).

Inclusion of non-taxable allowances and partly taxable allowances in salary help employees in saving tax and therefore, companies usually include several such allowances in CTC of employees.

Basic Salary – Basic Salary or Basic Pay, is the first and core component of your salary structure and a lot of other salary components such as HRA, Provident Fund, Gratuity, ESIC, etc. are calculated as % of basic pay. e.g. Provident fund at 12% of basic pay is deducted from salary.

Basic pay is the fixed amount earned by employees before any other payment such as allowance, or any other deduction such as income tax. e.g. the basic salary of an employee doesn’t change whether the employee achieves, or misses, the target for the sales commission.

The maximum amount in salary structure (sometimes up to 40% of CTC) is usually allocated under basic pay. The amount in basic pay is 100% taxable.

House Rent Allowance – House Rent Allowance (HRA) is the amount paid by an employer to an employee for renting his/her home, as part of the salary.

Salaried employees who are living in rented accommodations don’t need to pay income tax on the partial/complete amount in HRA (based on eligibility) and thus, HRA helps employees in reducing their tax liability.

The amount of tax savings that employees can have from HRA depends on following factors:

1. The amount allocated by company under HRA component in the employee’s salary

2. Actual rent paid by the employee

3. Amount in basic salary component

4. Whether the employee is living in a metro or non-metro city

Leave Travel Allowance (LTA) – Leave Travel Allowance (LTA) or Leave Travel Concession (LTC), is a salary component that companies include in CTC of employees to help them save tax on the amount spent on travelling within India, when they are on leave from work.

The amount in LTA is 100% tax-free, but LTA is not a common salary component and an employee can avail tax benefits under LTA only if the company has included LTA in the employee’s CTC.

Whether a company wants to provide LTA to an employee is solely at the discretion of company and companies generally have different LTA policies based on designation, pay scale, etc.

LTA covers only the cost of travel when an employee travels alone, or with family members. Cost of hotel, food, etc. can’t be claimed for tax exemption.

LTA can be claimed for any 2 journeys in a block of 4 years. Blocks are created by the income tax department. e.g. the current block is 2014-17 and the next block is 2018-21.

Medical Reimbursement – Medical reimbursement is the amount paid in form of monthly salary by an employer to an employee, for medical expenditure incurred by the employee as well as his/her family members.

Medical reimbursement of up to Rs. 15,000 per year is exempt from income tax if the employee submits proofs of expenses and tax benefits can be claimed under section 80D. If an employee doesn’t submit proof of expenses, the amount in medical reimbursement is liable for tax.

Expenses on doctor’s fee, medicines, hospitals, etc. can be claimed under medical reimbursement.

Medical Allowance – Medical allowance is a fixed allowance paid by an employer to an employee in form of monthly salary and employees are not required to submit any proofs for getting the medical allowance.

Unlike medical reimbursement which is tax-free up to Rs. 15,000 per year, the amount in medical allowance is 100% taxable.

Dearness Allowance (DA): Dearness Allowance (DA) is paid to government employees and pensioners in India & Bangladesh to counter the impact of inflation. Private companies in India don’t pay DA and even if a private company wants to pay DA, it can calculate DA as per its own rules.

DA is calculated as a fixed % of basic salary and because it is directly related to the cost of living, DA differs for employees based on their location. Dearness allowance is completely taxable for salaried employees.

Conveyance Allowance: Conveyance Allowance or Transport Allowance, is an allowance offered by employers to employees to compensate the cost of travelling from residence to office and vice versa.

Conveyance allowance of up to Rs. 1600 per month is tax-free, and any amount paid over this limit is taxable. Conveyance allowance is generally paid by employers to those employees for whom the employer doesn’t provide any transportation facility.

City Compensatory Allowance (CCA) – City Compensatory Allowance is an allowance given by employers to employees to compensate for the high cost of living in Tier 1 cities and sometimes, even Tier 2 cities.

There are no fixed rules for CCA from the government and it is given by employers at their own discretion. Generally, companies offer equal CCA to all employees living in a city, irrespective of their salary or designation. CCA is fully taxable.

Special Allowance: Special Allowance is a salary component which is used by companies to allocate additional salary to employees after utilizing other forms of salary components such as basic, HRA, leave travel allowance, medical allowance, etc. Any amount in special allowance is fully taxable.

Incentive Pay – Incentive Pay is the extra payment given to employees for achieving pre-defined goals or targets and is directly linked to employee’s individual performance on the job.

E.g. the company might set a sales target of Rs. 30 lakhs per month to an employee in the sales team and might agree to pay an incentive of Rs. 1.5 lakh on every 30 lakh of sales.

So, if the employee sells products worth Rs. 90 lakhs in a month, the company will pay an incentive of Rs. 4.5 lakhs to the employee.

Incentive model is clearly defined and communicated to the employees when they start working and if the employees achieve the goals, there is a guarantee that the incentives will be paid to the employees.

Incentives can be paid in cash or in form of other monetary awards. e.g. the company might bear the cost of an international holiday for the employee. Depending on company’s policy, incentives might or might not be a part of CTC. Incentives are fully taxable.

Bonus – Bonus is the extra money given to employees over and above their salary. e.g. if the company achieves the goals set for a year, it might distribute a fixed amount of bonus or a variable bonus (depending on each employee’s salary or designation) to all employees to reward them.

The bonus is dependent on the profitability of the organization and can be given to employees based on individual performance or company’s overall performance.

It can be given to all employees on a festival such as Diwali or can be given to an individual employee on joining the company, or for staying with the company for a long period of time.

The bonus is usually not a part of CTC, but some companies may include it in CTC if the amount of bonus is pre-decided. The bonus amount is fully taxable. Generally, the amount of bonus is not pre-decided and can vary based on various criteria.

Also, bonus usually has a surprise element and the company may or may not distribute the bonus if the company has not specifically committed it earlier.

Gross Salary – Gross Salary is the total salary that a company actually pays to an employee, before any deductions.

It is the total of all earnings, benefits, and allowances, before any deductions for government taxes (such as Income Tax and Profession Tax), social security schemes (such as Provident Fund), and health insurance.

e.g. the company might have taken a health insurance for you by paying a premium of Rs. 50,000 per year to an insurance company and therefore, Rs. 50,000 is included in CTC (because it goes out from the company for you,) but is not included in Gross Salary (because it doesn’t come to you).

Gross salary is always lesser that CTC and more than take-home salary because CTC includes all money that the company spends on you (even if it doesn’t pay you) whereas Gross salary is only the money that company pays to you.

Take Home Pay – Take Home Pay, In-hand Salary, or Net Pay, is the final salary that you get in your bank account (or through cheque or cash).

In other words, it is the final amount that is left after all applicable deductions for income tax, provident fund, employee state insurance, professional tax, health insurance, etc., are made from your gross salary by the employer.

The take-home salary is always lesser than CTC and Gross salary and in extreme cases, it might even be as low as 30-50% of CTC.

Click here to read more about the difference between take-home pay, gross pay, and CTC.

Severance Pay – Severance pay is the money offered by the employer to an employee who has been terminated or has left the company, as a gesture of goodwill.

Companies are not bound by any law to provide severance pay to employees, but companies sometimes offer severance pay in situations such as layoffs, job elimination, company shut down, etc.

In addition to money, companies can also offer health insurance, outside placement assistance, etc. as a part of the severance package.

Severance pay is different from termination pay (payment in lieu of notice) as termination pay is a part of the employment contract and the companies are legally bound to pay it.

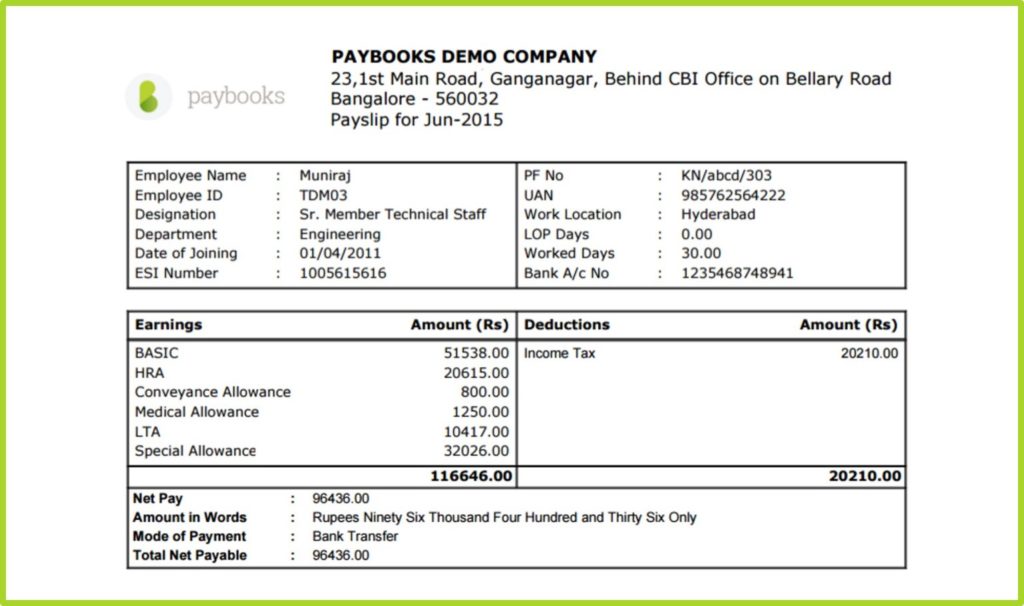

Paycheck – A Paycheck, Payslip, Payroll Stub, Pay Advice, Paycheck Stub, Salary Slip, or Pay Stub, is a document that an employee receives from an employer after getting the salary. It contains the details of net salary paid to the employee, along with the detailed breakup of various salary components.

The information on a paycheck is generally organized into 2 columns – 1st column contains details of all earning components such as basic, HRA, allowances, bonus, etc. and the 2nd column contains details of all deduction components such as income tax, insurance, etc.

Arrears Payment – Arrears Payment (or Retroactive Payment) refers to the money that should have been paid to an employee earlier, but wasn’t paid on time due to some reasons and so, it was paid later.

E.g. If you were paid 5,000 rupees less salary in a previous month because of a mistake in calculation, those 5,000 rupees will be paid later and will be mentioned as arrears payment in your salary slip.

Arrears Deduction – Arrears deduction refers to the money that shouldn’t have been paid to an employee earlier, but was paid due to some reasons and so, it was deducted later.

E.g. If you were paid 10,000 rupees more salary in a previous month because of a mistake in calculation, those 10,000 rupees will be deducted later and will be mentioned as arrears deduction in your salary slip.

Paid Leave – Paid leaves are the type of leaves from work during which you receive your normal salary. E.g. your company might give 27 days of leaves from work in a year and these leaves can be utilized when you go on vacation or fall sick.

These 27 days of leaves are ‘paid leaves’ as you’ll receive salary from the company for these 27 days even if you are on leave. Privilege leaves and sick leaves are examples of paid leaves.

Leave without Pay (LWOP or LOP) – Leave without Pay (LWOP), Loss of Pay (LOP), or Unpaid Leave, is when a company allows employees to go on leave but doesn’t pay them for those days.

This is generally required by employees when they have utilized all other forms of leaves and can be taken only if the company approves them as employees are not entitled to it.

E.g. if an employee meets with an accident and utilizes all his paid leaves, but needs more time to recover, the company might approve additional leaves without pay.

Casual Leave – Casual leaves are granted for urgent or unforeseen situations or other personal conditions where your presence is required for a short duration of 1 or 2 days. E.g. if someone in your family has fallen sick or you have a function in your child’s school.

Employees need prior approval of casual leaves from their manager except in cases when it is not possible to do so. E.g. if an employee falls sick, he/she can take the leave without approval and inform the company as soon as possible.

Generally, employees are not allowed to take more than 3 casual leaves in a month. Casual leaves can’t be carried forward, or encashed and automatically lapse at the end of the leave year.

Earned Leave (EL) – Earned Leave is the leave earned by an employee after working in the company for a certain amount of time, usually a month.

E.g. 2 days of earned leave for every 30 days of work in the company might be added to employee’s leave balance and the employee can later use it to take off from work.

Sick Leave (SL) – Sick Leave (also known as ‘Paid Sick Days’ or ‘Sick Pay’ or ‘Medical Leave’) refers to the number of paid leaves (employees get the salary for these leaves) that can be taken by employees when they fall sick.

The number of sick leaves given by companies varies in different states as per the Shops & Establishments Act, Factories Act, or other applicable laws. Generally, the sick leaves can’t be encashed or carried forward to next year and lapse at the end of the year.

Depending on the company policy, employees are required to submit medical certificates, if they take sick leaves for more than 2-3 days. Generally, there are no conditions of minimum working days for the employees to take sick leave.

Sandwich Leave – Sandwich Leave refers to the leave policy where even the days of public holidays and weekends are counted in your leaves if a public holiday or a weekend falls between your leaves or just immediately before, and after the leaves.

E.g. if an employee takes leave on Friday and Monday, even Saturday and Sunday (which is a holiday anyway) will be considered as leave taken and therefore, instead of 2 leaves, total 4 leaves will be deducted from the employee’s leave balance.

Similarly, if an employee applies for leave on 26th and there are public holidays on 25th and 27th, then instead of 1 day, total 3 leaves will be counted.

Though it looks unfair to employees, there are still many companies that follow sandwich leave policy to prevent employees from going on long holidays.

However, most of the progressive companies these days don’t follow this policy.

Maternity Leave – Maternity Leave (also known as Pregnancy Leave) refers to the period of time when a mother takes off from work because she is about to have a baby, or has just had (or adopted) a baby. Currently, women employees in India are eligible for 26 weeks of paid maternity leave.

Paternity Leave – Paternity Leave is the period of time when a father takes off from work at the birth or adoption of a child.

Currently, there is no law to give paid paternity leaves for male employees working in private sector in India. However, male employees in central government are given a paid paternity leave for 15 days.

Compensatory Off – Compensatory Off, Compensatory Leave, or Comp Off, is the leave or time off given to employees for working extra hours.

E.g. if an employee works on a holiday or a weekend, then instead of paying overtime salary to the employee, the company compensates for the extra work by giving a leave to the employee on any other working day.

Restricted Holiday – Restricted Holiday or Optional Holiday, is the holiday which is optional for each individual employee and each employee can decide whether he/she wants to take a leave on that day or not.

E.g. because Eid is a festival mostly celebrated by Muslims and Ram Navmi is a festival mostly celebrated by Hindus, both Eid and Ram Navmi can be a part of the list of restricted holidays in a company and people of related faiths can take leaves accordingly.

The entire office is not mandatorily closed on restricted holidays, but some or all employees can take leave on the restricted holiday. Generally, the list of restricted holidays in a company can contain many leaves, but each employee is allowed to choose max 2 holidays from the list of restricted holidays.

Leave Encashment – Leave Encashment means receiving cash from the employer for unused leaves. E.g. if an employee gets 15 earned leaves per year from the employer, but uses only 7 earned leaves in the year, the employee can get the money for remaining 8 leaves from the company.

There are no fixed rules for leave encashment, but most companies encash leaves annually, or at the time of leaving the company and the leaves are encashed on the basis of basic salary and dearness allowance.

Only some types of leaves such as earned leave or privilege leaves can be encashed. Click here to know the tax implications of leave encashment.

If you are looking for a tool to automate leave management in your company, check out Paybooks leave management software.

Leave Year – ‘Leave Year’ or ‘Holiday Year’ is the duration of time (generally a year) in which employers expect employees to utilize their annual leaves. In some businesses, leave year is the same as the financial year i.e. Apr 1 to 31st Mar.

In other businesses, leave year is the same as the calendar year i.e. 1st Jan to 31st Dec. In extreme cases, leave year can also be a duration of a year from the employee’s date of joining the company.

Leave rules are generally framed for a leave year. E.g. if a company gives 12 days of paid leaves in a year, those 12 leaves are actually applicable for a leave year.

Leave Policy – A Leave Policy is a set of rules & processes that govern the type and number of leaves that employees can take and contains details such as leave year, number of paid & unpaid leaves, leave encashment, mode of applying for leaves, rules for carrying forward of leaves.

Leave policies are designed in accordance with applicable leave laws. E.g. Maternity act in India mandates 26 weeks of leaves for working women and so, all companies that are covered under Maternity act need to give those leaves to their employees.

Run Payroll – Run Payroll means processing all payroll related data for final salary and tax calculation for a month (or a week, depending on pay cycle).

E.g. before the salary payout date, a payroll manager will have raw data of various things that affect salary & tax calculation for that month – leaves taken by employees, expenses claimed by them, incentive payments, etc.

Run payroll refers to the action of calculating final salary to be paid and taxes to be deducted for the month, after considering all these inputs.

If you use a payroll software, you’ll often see a ‘Run Payroll’ button in it. Once you click the button, the software will start calculating salaries and taxes.

Payroll Cycle – Payroll Cycle, Payroll Period, Payroll Schedule, Payroll Calendar, or Pay Cycle, is the frequency & schedule by which companies pay their employees and run payroll.

E.g. If a business pays its employees in every 7 days, it follows a weekly payroll cycle. Similarly, if a business pays its employees in every 30-31 days, it follows a monthly payroll cycle.

A typical payroll cycle covers all activities that a business needs to do to run payroll e.g. entering time & attendance data of employees, calculating salary after deducting taxes, paying salary to employees, paying taxes to the government, and making entries in the accounting system.

Payroll Reconciliation – Payroll reconciliation means verifying that the salary that was paid to employees was accurate, taxes to the government were paid and reported correctly, and proper accounting of payroll was done.

It is a good practice to do payroll reconciliation at least 1 or 2 days before the actual salary payout date so that you can catch any errors and correct them on time. After payment, payroll reconciliation is also done on a periodic basis (quarterly or yearly) to check and correct mistakes in past payments.

The process of payroll reconciliation usually involves comparing current month’s salaries and taxes to that of previous months, to figure out reasons for the difference.

It also includes activities such as validating ‘time in’ and ‘time out’ records of employees in payroll software with the corresponding attendance data in biometric devices.

Payroll Register – Payroll Register (also known as ‘Salary Register’) is a report (usually in a spreadsheet format) that contains the complete details of payments made, or to be made to all employees of the company.

Payroll register contains information such as employee name, employee code, all earning components such as basic & HRA, all deduction components such as income tax & provident fund, net pay, gross pay, month of payment, and mode of payment.

Payroll register is used to check the accuracy of calculations before making payment to employees and is also used for analyzing past payments.

Cut-off Date – Cut-off Day or Cut-off Date, is the deadline or last day by which all inputs must be received for calculation. E.g. if a company pays salary to its employees on 30th of each month, its payroll cut-off date could be 25th of each month.

That means, if an employee takes leave without pay on 28th of a month, the employee will get full salary for that month and the amount will be deducted from salary only in next month.

Base Days – Base Days is the number of days in a month used for calculating salary of employees. Depending on the company policy, base days in a month can be 28 days, 30 days, 31 days, the actual number of days in a month, or only working days in a month (after removing Saturday, Sunday or both).

Daily salary of an employee is calculated by dividing total monthly salary by base days and hence, base days affect those payments and deductions which are based on the number of days.

E.g. if the salary of an employee is Rs. 30,000 per month and the company takes 30 days as base days, employee’s daily salary will be Rs. 1,000 (30,000/30).

So, if an employee takes leaves without pay for 5 days, he will lose Rs. 5,000 and if an employee gets leave encashment for 5 days, he will gain Rs. 5,000 (assuming company deducts the full daily salary for leaves without pay and pays the full daily salary for leave encashment).

On the other hand, if the company takes only working days (after removing Saturday and Sunday) as base days, employee’s daily salary might be as high as Rs. 1363 (30,000/22) and therefore, in the previous example, an employee will lose Rs. 6818 or gain Rs. 6818.

Accrued Payroll – Accrued Payroll means all forms of compensation such as salaries, commissions, bonuses, etc. that have been earned by the employees but haven’t been paid to them.

Accrued payroll is a liability for the company and is therefore recorded as a liability (not expense) in the company’s books of accounts.

For example, the accrued payroll on 31st October would include the salary that the employees have earned till 31st October, but will not be paid until 10th November (salary payout date.)

Cost Center – A Cost Center or Expense Center, is a department or unit of the company that doesn’t directly generate revenue for the company but incurs a direct cost.

Cost centers are necessary departments or units that consume resources and are required for business setup and can’t be closed but don’t directly contribute to the production, sales, or profitability.

HR, payroll, accounting, and customer support departments are some of the examples of cost centers because they don’t increase sales in any way, but these departments are necessary for the smooth functioning of the company and can also save money in long-term.

There might be several cost centers even within a department. E.g. each assembly line, or even a specific machine could be a cost center.

Notice Period – Notice Period is the time period between the date of an employee’s resignation and his/her last working day in the company.

If the employee is terminated by the company, it is the time period between the notice of termination by the company and the actual termination date (or last working day).

Notice period helps both employees and companies in making backup plans and is generally given in writing through email or letter.

The notice period is mentioned in the offer letter given by the company to the employees at the time of joining and generally varies from anywhere between 7 days to 3 months, depending on company’s policies. For senior positions such as CEO or CTO, the notice period can be as long as 1 year.

Notice Pay – Notice Pay or Termination Pay, is the amount that the employee receives from the company (or pays to the company) if the company terminates the employee (or the employee leaves the company) without serving the agreed notice period.

e.g. The employment contract of a company might mandate the employee/employer to a serve notice period of 1 month or pay 1 month salary on resignation/termination, but if the company wants to terminate an employee immediately, without informing the employee 30 days in advance, company will have to pay salary of 1 month to the employee because of breach of contract and vice versa.

Probation Period – When a company hires a new employee, it generally uses a short duration known as probation period (usually ranging from 1 month to 6 months) to test whether the employee is a right fit for the company or not.

If the employee meets company’s expectations during the probation period, the company gives a permanent job to the employee. Else, the company might terminate the employee.

The notice period during probation is usually a short duration (as less as a week or 15 days) and thus, it is easier for both the employee and the company to end the employment if things don’t work out.

An employee on probation period might not get all the benefits that are given to the permanent employees of the company. E.g. only limited leaves might be allowed to an employee on probation.

Challan – A challan is a pre-filled form (online or printed) in a specific format used to deposit money into bank accounts of government. E.g. all employers need to deduct income tax from the salary of employees and deposit it in the government account.

They do this using a tax challan that contains the details of the amount to be paid, to whom it needs to be paid and how it needs to be paid (cash or net banking). After the payment, a copy of the challan is given to the employers for their records.

Direct Deposit – Direct deposit means the direct online transfer of an employee’s salary to his/her bank account on the date of salary payment.

As opposed to paying employees by cash or cheque, paying them by direct deposit helps companies in saving costs and time, because all payments are conducted online within minutes.

With direct deposit, employees also don’t need to spend time in carrying physical cheques to their bank and getting them encashed.

Paybooks is India’s 1st payroll software with a direct deposit facility. After running and confirming payroll in Paybooks cloud payroll software, you can initiate direct deposit and your employees will receive their salary directly into their bank account within minutes.

Full & Final Settlement (FFS) – Full and Final Settlement is the process of calculation and payment of the final amount to an employee on his/her exit from the company, due to resignation or termination.

E.g. when an employee leaves the company, the company might need to pay money to the employee for various things such as last month’s salary, leave encashment, gratuity, or sales commission.

Similarly, the company might also need to recover various assets and payments due from the employee. E.g. the company might have given a loan to the employee and so, the remaining loan amount needs to be deducted from the employee’s final salary.

Additionally, the company might need to recover assets such as laptops, mobile phone, etc. that were given to the employee for performing his/her duties.

The full & final settlement means calculating all such payments and recoveries, conducting exit interviews, paying the final amount to employees, and giving them relieving letter and experience letter.

Ex Gratia Payment – ‘Ex Gratia’ means ‘From Favor’ in Latin and an ‘ex gratia’ payment is a payment that is made by an employer, organization, insurer, or government, completely at its own discretion and it didn’t have any obligation or liability to pay it. An ex gratia payment is made as a gesture of goodwill.

e.g. a company might pay an ‘ex gratia’ amount of Rs. 10 lakhs over and above all pension-related benefits that are mandated by laws for a retiring employee, even when there was no necessity to do it.

Similarly, if an insurance company was liable to pay Rs. 30 lakhs for a damage, it may pay Rs. 35 lakhs after including an additional ex gratia payment of Rs. 5 lakhs.

Salary Variance Report – Salary Variance Report is used to know the difference between salaries paid out to employees in various months.

It contains details of all earning and deduction components for each individual employee for given months and highlights the difference between amounts in each component.

Salary variance report is very useful for identifying mistakes in salary calculations. E.g. salary variance report might show an additional payment of Rs. 40,000 in the current month compared to previous month when the employee wasn’t supposed to earn anything extra.

The difference could have been because of an incorrect entry in payroll spreadsheet.

Salary Transfer Statement – Salary Transfer Statement (also known as Bank Statement) contains details of the salary to be paid out to the employees of the company from the company’s bank account.

It contains details such as employee’s name, unique ID, account number, net salary to be paid, and the mode of payment (cheque/online transfer). A bank statement is generally an excel file or a text file and needs to be uploaded to the bank’s portal by the company.

Most payroll software automatically generate ready to upload bank statement after payroll run. But if a company doesn’t use a payroll tool, they create bank statements manually in spreadsheets or notepad.

Payroll Software – A Payroll Software, Payroll System, Wages Software, Payroll Calculator, or Compensation Software, is a software that automates all tasks related to payroll management.

These tasks generally include leave & attendance tracking, expense claims management, employee database management, salary & tax payment, report generation, etc.

With a payroll software like Paybooks, employers can manage payroll in minutes and pay accurate salaries to employees. Most payroll-related laws are auto-updated in a payroll software, so employers don’t need to worry about frequent changes in laws if they use a payroll software.

Employee Self Service (ESS) – Employee self-service (ESS) is an important feature in online payroll & HR software and refers to the online login given to each employee in the software.

From ESS login, employees can view pay slips, apply for leaves & expense claims, submit income tax declarations, etc., from anywhere, anytime. Modern HR companies such as Paybooks now also offer a mobile app for employee self-service.

With employee self-service, employees have the access to all their personal & professional information in real time and unlike old days, they don’t need to wait for getting their pay slips or leave balance from the HR.

Manager Self Service (MSS) – Manager self-service means employee self-service given to managers, with additional privileges to view details of their subordinates.

A manager self-service is given to managers who have some employees reporting to them so that the manager can view additional details such as leaves & expense claims submitted by their team members and can approve or reject them.

Payroll Journal Entry – A Payroll Journal Entry is an entry in the accounting system for all transactions related to payroll such as compensation paid to employees, deductions made from employee’s salary, and the amount paid to the government for various payroll related taxes.

e.g. Paybooks cloud payroll software is integrated with QuickBooks accounting tool and it automatically posts payroll journey entry in QuickBooks for all payroll transactions.

Legacy Payroll Data – Legacy Payroll Data is the payroll data for a previous period (usually years).

E.g. If a company was managing payroll using spreadsheets earlier and now wants to use a payroll software, it will have to upload its old payroll data of previous years (legacy payroll data) into the software so that it can view complete data in one place.

Most payroll software companies charge an additional fee for storing legacy payroll data and therefore, you should specifically enquire about the price before finalizing any payroll vendor.

Payroll Outsourcing – Payroll Outsourcing or Managed Payroll Service, means hiring an external firm or agency to manage all payroll related functions of the company such as salary calculation, compliance management, or answering employees’ queries.

Businesses outsource payroll to save time & money, avoid hiring & training of internal payroll staff, increase focus on core business, etc.

By outsourcing payroll, businesses can focus on more strategic tasks such as leadership hiring, research & development, and new market penetration.

Payroll outsourcing also helps businesses in leveraging the expertise of outside payroll professionals to follow best practices in compensation & compliance management.

Employee Life Cycle (ELC) – Employee Life Cycle covers all stages of an employee’s interaction with the company from entry to exit.

Companies want employees to have a positive experience with them during all stages of employee life cycle such as recruitment, onboarding, career development, retention, and separation and therefore, they have well-defined processes for each of these activities.

Contract Labour – Contract Labours are indirect employees – people who work for the company, but are hired, managed, and paid by a third party, or contractor and the contractor is paid by the company.

Contract labours do not have any direct relationship with the company and are generally hired for temporary tasks for a specific duration. e.g. companies generally have sweepers, cleaners, etc. as contract labour.

They work from premises of the company, but are not the employees of the company and are paid by the contractors who have hired them.

Principal Employer – Principal Employer is the person or the company which hires employees directly or through a contractor (immediate employer).

E.g. if contractor A hires contract labour such as security guard for company B, company B is the principal employer. Company B is also the principal employer for all employees that it has employed directly.

Immediate Employer – Immediate employer is the contractor who hires contract labour for a principal employer. E.g. if contractor A hires contract labour such as security guard for company B, contractor A is the immediate employer.

Employee Contribution – Employee Contribution means the amount deducted from the salary of an employee for employee benefits programs such as employee provident fund, employee pension schemes, employee state insurance, etc.

E.g. 12% of employee’s basic pay is deducted from employee’s salary and deposited in provident fund account each month by the employer. Employee contributions reduce tax liability for the employees in short-term and they gain benefits in the long run.

Employer Contribution – Employer Contribution means the amount paid by the employer for employee benefits programs such as employee provident fund, employee pension schemes, employee state insurance, etc.

E.g. employers pay 4.75% of employee’s gross salary towards employee state insurance.

Provident Fund (PF) – Provident Fund (PF) or Employee Provident Fund (EPF), is a long-term savings scheme, or retirement benefits scheme to provide financial security to salaried employees working in private, public, and government organizations in India.

The scheme is backed by the government and applies to all companies with more than 20 employees.

Under this scheme, employers deduct a fixed amount from the salary of employees (currently 12% on the sum of basic salary & dearness allowance) each month and deposit it in provident fund account with the government.

Additionally, a contribution of the same amount (employer’s PF contribution) is also made by the employer from its side on behalf of employees, but 3.67% of that amount goes into EPF and the remaining 8.67% goes towards Employee Pension Scheme.

Employees receive tax-free compounding interest on the amount in EPF account which leads to a steady growth of their money and the employee gets his full share and the employer’s share (3.67%) on retirement.

Employees can withdraw money from their PF account if they are unable to work temporarily, or permanently and on some other conditions.

Employees Provident Fund Organisation of India (EPFO) – EPFO is a statutory organization under the administrative control of the Ministry of Labour and Employment, Government of India.

EPFO helps in the administration of Provident Fund Scheme, Pension Scheme, and Insurance Scheme for the employees in organized sector in India.

EPF Wages – EPF Wages is the amount on which the employer’s share of EPF contribution is calculated. E.g. if an employer makes EPF contribution on employee’s basic salary of Rs. 30,000, the amount of basic salary i.e. Rs. 30,000 will be considered as EPF wages.

PF Electronic Challan cum Return (ECR) – PF ECR is a report (electronic return) that employers need to upload every month online on the website of PF department. The report contains details of wages and contributions of employees, along with their basic details.

The data of uploaded return will be displayed through a digitally signed copy in PDF format. Once the employer approves the return, an online challan will be generated using which the employer can make the final payment for all contributions to the government.

The payment can be made either through net banking or by visiting the bank’s branch.

With PF ECR, the employers no longer need to visit PF department to submit any paper return and they also don’t need to submit any other PF forms such as Form 5/10/12A,3A, and 6A.

Universal Account Number (UAN) – UAN is a unique 12 digit number which is given to each individual who has a provident fund account and helps employees in viewing the details of all his/her PF accounts with the current & previous employers, from PF portal.

Earlier, when an employee used to join a new company, the company used to open a new PF account for the employee, but it was not connected to the employee’s old PF accounts.

Hence, it was very difficult for employees to track amount in their multiple PF accounts and they had to run to multiple previous employers if they wanted to withdraw the money.

UAN connects all PF accounts of an employee and allows portability of PF accounts from one employer to another so that EPF balance can be easily transferred from one account to another and employees can withdraw money from their PF accounts without any interference from the employers.

Temporary Return Reference Number (TRRN) – TRRN is a temporary number using which you can check the status of PF challan payment. After you make the payment for PF using PF ECR file from PF portal, the status of payment is not reflected immediately and remains under process for some time.

Using TRRN number, you can check the status of PF challan payment and download it in PDF format without logging into the PF portal.

Voluntary Provident Fund (VPF) – VPF is an investment option which can be utilized only by salaried employees who have an employee provident fund account.

Employees can utilize this scheme by voluntarily contributing an additional amount to provident fund account on top of the mandatory contribution of 12% of their basic salary.

However, unlike Employee Provident Fund (EPF), the employer doesn’t need to contribute any amount to VPF from its side.

VPF is a very attractive investment option as interest rate and tax savings on VPF and EPF are the same, but unlike EPF, there is no maximum ceiling of 12% contribution on basic salary and employees can contribute up to 100% of their basic salary and dearness allowance in VPF.

To opt for VPF, employees need to inform their employer about the additional contribution that they wish to make and the employer will start deducting the additional amount from their salary and start depositing it in their EPF account (there is no separate account for VPF).

Public Provident Fund (PPF) – PPF is a long term savings-cum-tax-saving instrument backed by Government of India, but unlike employee provident fund (EPF), employer plays no role in the public provident fund (PPF).

Under this scheme, a person of any age can open a PPF account in a bank, or post office and can deposit a maximum amount of Rs. 1.5 Lakhs in a financial year. To keep the account active, minimum amount of Rs. 500 needs to be deposited in each financial year.

The principal amount deposited in PPF account can be claimed for tax savings under Section 80C of Income Tax Act and the entire interest earned on this amount is tax-free.

PPF has a lock-in period of 15 years and the entire amount (principal + interest) can only be withdrawn on maturity. However, subscribers can avail loans against the deposited amount from 3rd to 6th year and can also withdraw partial amount (subject to conditions).

Employee Pension Scheme, 1995 – Employee Pension Scheme (EPS) or EPF pension, is a pension scheme for all employees of the organized sector and offers guaranteed monthly pension of minimum Rs. 1,000, after retirement, on disablement, and for widows and nominees.

Pension account of employees is managed by Employee Provident Fund Organization and all employees with an employee provident fund account are automatically enrolled for EPS. An employee doesn’t contribute directly towards EPS and the contribution for EPS comes from employer’s share.

Out of the 12% of basic salary that employers contribute towards PF each month, 8.33% goes into EPS.

To know more about EPS, click here.

EPS Wages – EPS Wages is the amount on which the employer’s share of EPS contribution is calculated. E.g. if an employer makes EPS contribution on employee’s basic salary of Rs. 6,000, the amount of basic salary i.e. Rs. 6,000 will be considered as EPS wages.

Tax Deducted at Source (TDS) – TDS is a means of collecting income tax in India, under the Income Tax Act, 1961.

As per the act, any company or person making a payment needs to deduct TDS at the rates prescribed by tax department in advance and deposit the deducted tax amount in the account of the Central Government, if the payment exceeds a certain threshold.

TDS is deducted on all types of regular and irregular incomes such as payments of salaries, commissions, rent, consultation fees, professional fees, interest payment by banks, etc.

E.g. when employers pay salary to employees, they deduct income tax from their salaries based on income tax slab and deposit the amount in the account of government.

Similarly, when a company makes payment to another company for its services, it first deducts TDS from the payment and then pays the remaining amount to the other company. For more details on TDS and threshold limits, click here.

Withholding Tax – Withholding Tax or Retention Tax, is the same as Tax Deducted at Source (TDS) and is more prevalent in the context of cross-country payments or foreign transactions.

When payment is made to people of India, the tax deducted is termed as TDS whereas when the payment is made to Non-Resident Indians or foreign companies, the tax deducted is termed as withheld tax.

To read more about withholding tax rates, click here.

TDS Certificate – Every person or company deducting TDS needs to give a certificate containing details of the tax deducted to the payee. This certificate is called TDS certificate.

E.g. Form 16 is a TDS certificate that is given by an employer to an employee at the end of the year. It contains the details of total tax deducted from the employee’s salary by the employer.

Tax Deduction and Collection Account Number (TAN) – TAN is a unique 10 digit alphanumeric code issued to persons who are required to deduct or collect tax on payments made by them, as per income tax rules in India.

TAN is issued by the income tax department and it is mandatory to quote TAN in all TDS (Tax deduction at Source) returns and challans.

E.g. when an employer pays salary to an employee, the employer deducts income tax from the employee’s salary as per the Income Tax Act and submits TDS return containing details of tax deducted from the employee’s salary to the income tax department.

The employer quotes its TAN in this TDS return. A sample TAN number is DELM12345L – First 4 digits are alphabets, the next 5 digits are numeric and the last digit is an alphabet.

Tax Collected at Source (TCS) – TCS is the income tax collected by sellers in India from buyers on sale of certain items such as cars above Rs. 10 lakhs, jewellery above Rs. 5 lakhs, tendu leaves, scrap, and other goods specified under section 206C of the Income Tax Act, 1961.

e.g. if a seller sells scrap worth Rs. 10,000 to a buyer, the seller will collect Rs. 10,100 (10,000 for scrap + 100 for TCS) from buyer and will pay Rs. 100 as TCS to the government. The buyer gets the tax credit for TCS and can claim it at the time of filing income tax return.

TDS Return – Every person or company which has deducted TDS needs to file quarterly TDS returns to the government in electronic form.

The returns contain details such as the amount of tax deducted, type of payment, PAN number, TAN number, etc. and need to be filed in specific forms such as Form24Q, Form26Q, Form27Q, etc., based on the purpose of TDS deduction.

Form 24Q – Form 24Q is used to file the return for tax deducted at source from domestic salary payments.

Form 26Q – Form 26Q is used to file the return for tax deducted at source on all domestic payments except salaries.

Form 27Q – Form 27Q is used to file the return for tax deducted at source on interest, dividends, or any other sum payable to Non-Resident Indians.

Form 27EQ – Form 27EQ is used to file the return for tax collection at source.

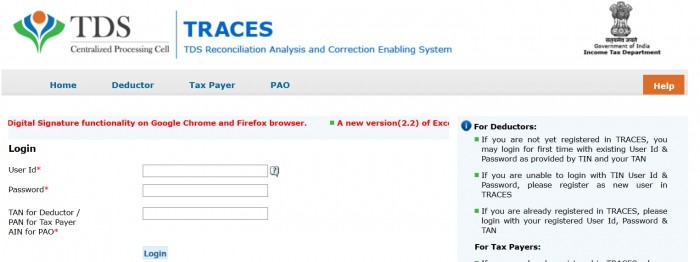

TRACES – TDS Reconciliation Analysis and Correction Enabling System (TRACES) is a web-based application of the Income Tax Department that has been created for swift interaction between all stakeholders of TDS administration – TDS deductor, TDS deductee, income tax department, and Centralised Processing Cell (CPC).

TRACES has brought transparency to the taxation process and has made it more efficient. Some of the features available for deductors and deductees on TRACES are online filing & correction of TDS statements, TAN registration, view & download of Form 26AS, Form 16, etc.

Employee State Insurance (ESI) – Employee State Insurance is a social security and health insurance scheme for Indian workers earning less than or equal to Rs. 21,000 per month.

The scheme is designed to socially protect employees in the organized sector against sickness, disablement, unemployment, death due to employment injury, etc.

ESI is applicable to any firm or establishment which employs 10 or more employees and the companies need to register with ESIC within 15 days from the date of its applicability to them. Employees covered under ESI receive many benefits, not only for themselves but also for their families.

E.g. Employees covered under ESI can get medical treatment for themselves and their dependents at more than 1,500 hospitals & clinics run by the ESIC, directly or indirectly.

They also receive cash compensation for loss of salary or earning capacity due to sickness, employment injury or unemployment. Other benefits include disablement benefits, maternity benefits, family pension, funeral expenses, etc.

Currently, the employee’s contribution rate to ESI is 1.75% of gross salary (basic + allowances) and the employer’s contribution to ESI is 4.75% of the gross salary. For newly implemented areas, the employee contribution rate is 1% and employer contribution rate is 4% for first 24 months.

Employees receiving a daily average wage of up to Rs. 137 don’t need to pay their share of contribution, but employers still need to contribute their share for such employees.

It is the employer’s responsibility to deduct the amount from employees’ salary, add employer’s contribution and make payment to ESIC.

Employee State Insurance Corporation (ESIC) – ESIC is an autonomous statutory body that administers ESI scheme and falls under the Ministry of Labour and Employment, Government of India.

It was set up under ESI act of 1948. The body comprises of representatives on behalf of employees, employers, Central Government, State Governments, etc.

Employee State Insurance Act, 1948 – The Employee State Insurance Act, 1948 stipulates various rules & regulations that govern the functioning of the Employees’ State Insurance Corporation (ESIC), which manages the ESI fund. The act is applicable to any firm or establishment which employs 10 or more employees.

ESI Card – ESI Cards or ESI Pehchan Cards, serve as a means for identification of the employee, and his/her family members and can be used for availing medical and cash benefits. The cards contain employee’s name, father’s name, address, insurance number, photograph, finger prints, etc.

One ESI card is issued for the employee, or insured person and the other is issued for his/her family members. Temporary ESI card is issued to the employee by the employer and the employee needs to go to any branch of ESIC to get the permanent ESI card.

Professional Tax (PT) – Professional Tax or Profession Tax, is a tax levied by the state government in India on all individuals who earn an income through salary or practice a profession (such as doctors, lawyers, chartered accountants, etc).

The tax is applicable to all working individuals, business owners, and people carrying out all types of occupations.

Professional tax is just like income tax, but instead of the central government, it is collected by the state government and therefore, the rules for professional tax vary from state to state. Not all states in India collect professional tax in India. E.g. Delhi doesn’t have professional tax whereas Karnataka does.

It is the duty of employers to deduct professional tax from the salary of employees and submit it to the state government.

The amount charged for professional tax depends on the income of individuals and varies with slabs of income fixed by the state government. The amount charged for the professional tax is generally very low and the maximum professional tax in most states is only Rs. 200 per month.

Employee Deposit Linked Insurance Scheme (EDLI) – EDLI is a life insurance policy taken by companies in the organized sector for its employees.

The EDLI scheme applies to all companies covered under Employee’s Provident Fund and Miscellaneous Provisions Act, 1952 and thus, all employees who have a provident fund account are automatically covered under EDLI.

EDLI scheme is transferable when an employee switches jobs and the contribution from the new employer will be made in the old account.

As per the scheme, if an employee dies during the service, a lump sum payment of up to Rs. 6 lakhs (depending on employee’s last drawn salary) is made to the employee’s nominated beneficiary.

A company can opt out of EDLI if it provides a group term insurance cover to all its employees with equal or more benefits than EDLI.

The insurance premium for EDLI i.e. 0.5% of the employee’s monthly basic pay (capped at Rs. 15,000) is paid by the employer and no contribution is required from the employee.

EDLI Wages – EDLI wages is the amount on which the employer’s share of EDLI contribution is calculated. E.g. if an employer makes EDLI contribution on employee’s basic salary of Rs. 10,000, the amount of basic salary i.e. Rs. 10,000 will be considered as EDLI wages.

EDLI Admin Charges – EDLI Admin Charges are payable by the employer to the government for administration of EDLI. These charges have been waived off from 1st April, 2017.

Form 16 – Form 16 is a certificate issued by an employer to an employee if the employer deducts income tax (TDS) from the salary of the employee.

Form 16 contains details such as salary of employee, tax deducted from salary, employer’ tax deduction number, declarations of tax savings made by the employee, etc.

After the end of each financial year (1st Apr – 31st Mar), employees need to file income tax returns for the year and so, they need Form 16 from their employer. Form 16 is given to employees once in a year, between the end of financial year and the last date of filing tax returns (usually 31st July).

Form 16 is divided into two parts – Part A and Part B.

Form 16 Part A – Part A of Form 16 contains the name, address, and PAN number of both employee and employer, along with the summary of total salary paid to the employee during the year and the amount of income tax deducted from salary, and deposited in the government account by the employer.

Form 16 Part B – Part B of Form 16 contains most of the details that an employee needs to file income tax return. It contains detailed information on the employee’s salary such as gross income, taxable income, all deductions made from salary for provident fund, pension, health insurance, etc.

It also contains detailed information on all investments made by the employee for tax savings such as fixed deposit, mutual fund, etc.

Form 26AS – Form 26AS is an annual consolidated statement of the total tax paid by the tax payer as per the database of income tax department and is required for filing income tax return.

It contains details of the tax paid to the government directly by you or by others on your behalf (such as your employer and banks).

Form 26AS can be accessed by all tax payers from income tax website TRACES by using PAN number. Form 26AS contains the details of tax collected at source, tax deducted at source, along with other forms of tax payments such as self-assessment tax, advance tax, etc.

It reflects the total tax credit in PAN of the tax payer. Form 26AS contains details such as the name & PAN of the deductee, name & PAN of the deductor, and the TDS amount deposited with the Government.

Form 12BB – Form 12BB is an investment declaration form in which employees need to mention all investments made by them for tax savings in the financial year and submit it to the employer at the end of financial year.

The employees need to fill their name, pan number, and details of investment in fixed deposits, mutual funds, life insurance, etc. in the form.

The employers consider Form 12BB for deducting income tax from the employee’s salary and give the tax benefits to the employee based on the investment declarations in the form.

If an employee doesn’t submit Form 12BB to the employer, the employee won’t get tax saving benefits on his/her investments and will end up paying more tax.

Gratuity – Gratuity is the extra lump sum amount paid by an employer to an employee when the employee leaves the company after continuous service of 5 years or more.

In the case of retirement, superannuation, death, or disability, the employer will pay gratuity even if the employee has not worked for continuous 5 years.

Gratuity is a retirement benefit that is applicable to both government employees as well as private sector employees. The entire gratuity amount is tax-free for government employees whereas gratuity amount of up to Rs. 10 lakhs is tax-free for private sector employees.

All companies with 10 or more employees need to pay gratuity as per the rules and regulations in the Payment of Gratuity Act, 1972.

Formula for Gratuity Calculation = [ (Latest Basic Pay + Dearness Allowance) x 15 days x No. of years of service ] / 26

You can instantly calculate your gratuity amount with this easy gratuity calculator.

The Payment of Gratuity Act, 1972 – The Payment of Gratuity Act, 1972 laid down detailed rules and regulations for gratuity payment to employees of both private and public sector. The act was passed by Indian Parliament on 21st August, 1972 and the act came into force on 16th September, 1972.

The act applies to the whole of India except the state of Jammu & Kashmir. All organizations with 10 or more employees are covered under the Gratuity Act and once the act applies to an organization, the act will continue to apply even if the number of employees in the organization falls below 10.

The Maternity Benefit Act 1961 – The Maternity Benefit Act of 1961 protects the employment of women before and after the birth of a child and entitles women to several maternity benefits (such as paid leaves during pregnancy) so that they can take care of their child.

All establishments with 10 or more employees are covered under the Maternity Act.

The Maternity Benefit (Amendment) Act 2017 – The Maternity Benefit (Amendment) Act 2017 is an amendment to the Maternity Benefit Act, 1961 and came into effect from 1st April, 2017.

It brought several changes to the 1961 act such as increasing the duration of paid maternity leave from 12 weeks to 26 weeks and providing work from home option.

Muster Roll – A Muster Roll is a labour attendance register for a particular worksite and a particular period (such as 3 weeks). E.g. a company with 5 branches will need to maintain muster roll for all 5 locations.

Muster Roll contains complete records related to labour such as attendance, payment, overtime, leaves, advance payments, etc.

Companies need to maintain muster roll as per the Shops & Establishments Act and Factories Act. Based on the industry and the applicability of labour laws, companies might need to maintain several muster roll registers such as overtime muster roll, muster roll with wages, etc.

Factories Act, 1948 – Factory Act, 1948 is an extensive act that regulates working conditions in factories and has several provisions for safety, health, and welfare of the workers when they deal with machinery.

It regulates working hours, shifts & overtime, leaves, holidays, employment of women & children, amenities, etc.

The Factories Act applies only to factories and is applicable across India to factories with 10 or more workers.

The Employee’s Compensation (Amendment) Act, 2017 – The Employee’s Compensation (Amendment) Act, 2017 amended the old Employees’ Compensation Act, 1923 and received the President’s approval on 12th Apr, 2017. It added several new provisions for the protection of employees’ compensation.

As per the new act, it is mandatory for all employers to clearly state the compensation to employees in writing as well as electronic means and if any employer fails to do so, the employer will be liable for a penalty of Rs. 50,000 which may be extended to Rs. 1 lakh.

The Minimum Wages Act 1948 – The Minimum Wages Act 1948 sets the minimum wages to be paid to both skilled and non-skilled labours in certain employments in India and gives the power to fix minimum wages to State government and Central Government.

Because the states have the power to fix minimum wages, rates for minimum wages differ across states, regions, industries, skills, occupations, etc.

The act has provisions for fixing wages, working hours, overtime pay, etc. and all establishment covered under the act need to maintain the register of wages, attendance, overtime, etc. at the workplace.

The act is applicable across India to all establishments employing one or more individuals included in the scheduled employment list and every employee working in a scheduled employment is covered under the Act.

You need to comply with this act right from the day 1 of company formation.

The Payment of Wages Act, 1936 – The Payment of Wages Act, 1936 was enacted to prevent delay in payment of wages and to avoid unauthorized deductions from wages and applies to the whole of India.

It regulates the payment of wages to certain classes of employed persons and has provisions for fixing wage period, time of payment of wages, and maintaining wage registers.

The wage limit for applicability of the Act was enhanced from Rs.18000/- per month to Rs.24,000/- in August, 2017.

The Payment of Wages (Amendment) Act, 2017 – The Payment of Wages (Amendment) Act amended the old Payment of Wages Act, 1936 and came into force from 28th December, 2016.

The new act allows companies to pay wages to workers in non-cash modes such as bank transfer and cheques, without formal approval from workers.

Contract Labour Act – The Contract Labour (Regulation & Abolition) Act, 1970 regulates the employment of contract labour and has various provisions to bring them at par with directly employed labour in terms of working conditions and other benefits.

It also tries to abolish contract labour in certain circumstances.

The Contract Labour Act is applicable to all establishments in India which employ 20 or more contract labours.

The Building and Other Construction Workers Act, 1996 (BOCW) – BOCW or Regulation of Employment and Conditions of Service Act, 1996 (RE&CS) is an act to regulate the employment and conditions of construction workers and has provisions for their for their health, safety, and welfare measures.

The act extends to the whole of India and applies to every establishment which employs 10 or more building workers in any building or other construction work.

Disclaimer – While we try to present the accurate and updated information on our site, there is absolutely no assurance that the information in this article is accurate, precise, or correct. The information provided in this article is, at best, of a general nature and shouldn’t be considered as any form of advice for anything (especially for legal compliance.)

Neither the author of this article nor anybody else connected to Paybooks can be held responsible for any claims or losses because of the information in this article.